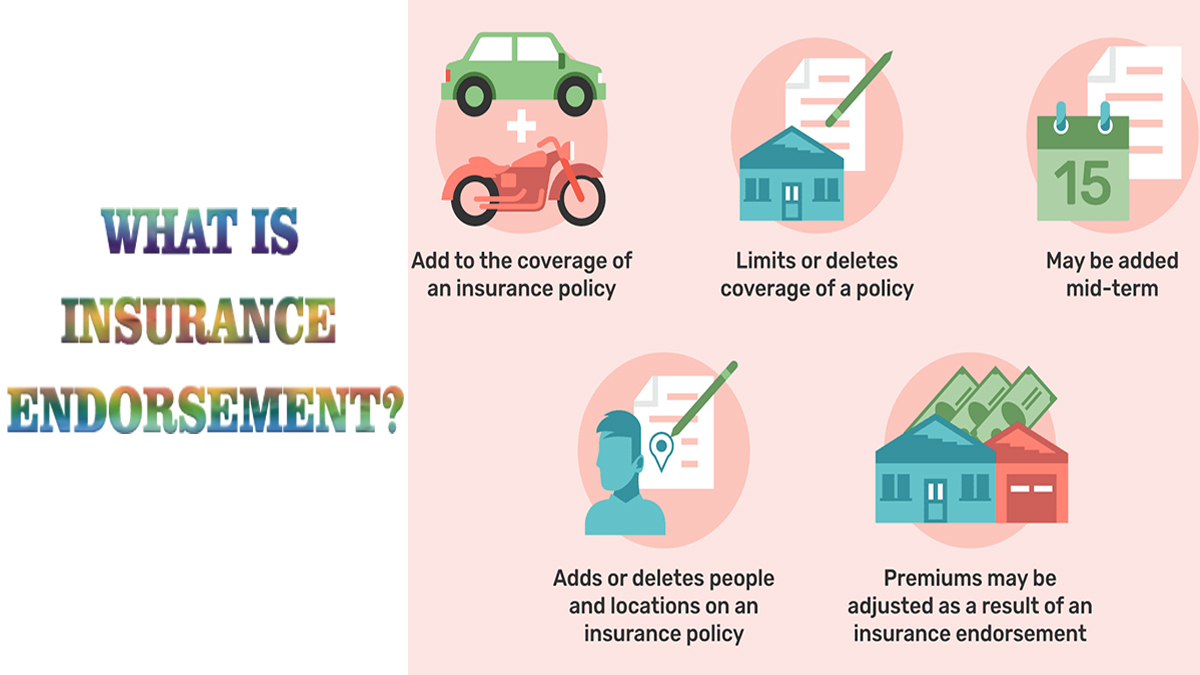

What is an Insurance Endorsement? This is a modification to an existing insurance policy that changes the terms of the initial policy. In other words, if you are a policyholder, your premiums may alter due to an endorsement. Insurance endorsements are frequently used on casualty and property and are also known as “riders.”

In addition, there are various types of insurance endorsements. And, they offer different coverage. Therefore, when you decide to go for an insurance endorsement and you make these changes, these changes will be visible till your policy expires.

But, if you ever receive a notice about having your policy endorsed, make sure that you speak to an agent or representative to gain knowledge about this new change. To find out how insurance endorsements work, keep reading.

How Do Insurance Endorsements Work?

How insurance endorsements work is very easy. With an insurance endorsement, you can delete, change, exclude, and even add insurance coverage.

What’s more, insurance endorsements can be provided at renewal time, time of purchase, or mid-term. However, you also need to be aware that your insurance premiums can also be altered and affected. This is the aftermath of this process.

With this change, you will be able to boost your typical limits of coverage. You can also take authority over the original policy. Therefore, if you already have a policy and you wish to add more coverage, all you need is an insurance endorsement.

Types of Insurance Endorsements

There are different types of insurance endorsements and they cover different areas. So, if you get an insurance endorsement on your policy, you will be able to add and remove coverage that you wish to keep. Some of the types of insurance endorsements include:

- Personal Property Endorsement.

- Flood Endorsement.

- Water Endorsement.

- Home Business Endorsement.

- Identity Theft Endorsement.

- Earthquake Endorsement.

- Canine Liability Exclusion Endorsement.

- Additional Insured Endorsement.

Personal Property Endorsement

The Personal Property Endorsement is possible for individuals with properties in any location. Therefore, you can change or alter your policy to add or remove new coverage to your existing insurance policy.

Moreover, with this type of endorsement, you can include coverage for your valuables like art, jewelry, and many more. You can also get reimbursed if your personal property is stolen or damaged.

Scheduled Personal Property Endorsement coverages include:

- Mislay of property use.

- Your property’s dwelling place itself.

- Medical coverage.

- Personal Liability.

- Personal property.

The Personal Property Endorsement also allows you to extend coverage to your mailbox, sheds, and fences.

Flood Endorsement

Floods can be unexpected. But if you do not want to be caught off-guard, then you can go for a flood endorsement. Moreover, if you have a homeowners’ insurance policy that does not cover flooding, then getting a Flood Endorsement is not a bad idea.

Plus, for individuals who are residing in a high-risk flood area, this process is highly recommended. The Flood Endorsement covers the reconstruction and repair of a building or buildings that have experienced flood damage.

Water Endorsement

Damages caused by water can be very expensive and difficult to cover up. Furthermore, if your property is damaged by water, there are issues like mildew and mold that you also need to get rid of.

But a water endorsement will help you cover and manage the cost of repair and refurbishing. So, if you live in an area that has sewage problems, getting this endorsement is highly advisable.

Home Business Endorsement

If you are a small business owner, the Home Business Endorsement is ideal to get. Moreover, individuals who are also running small businesses out of their homes can also get this coverage. Unfortunately, not all homeowners’ insurance policies cover this expense.

But if you operate an at-home business, you can include and have the Home Business Endorsement added to your policy to keep you protected.

Identity Theft Endorsement

Identity theft is one of the most common fraudulent activities that take place in the world. So, if you ever have your identity stolen or you fear that a day like that will come, you can ask for an Identity Insurance Endorsement.

Moreover, this type of support can assist you with paying for fraud services, identification replacement, and legal fees. With this type of coverage, you do not have to get worked up about keeping track of your credit reports.

Earthquake Endorsement

Earthquakes are one of the natural disasters in the world. They also cause a lot of damage to properties as well as lives. But, with the help of the Earthquake Insurance Endorsement, damage related to this event will be covered.

So, if you live in an area that is prone to earthquakes, for instance, California, you can get coverage when you ask and add this to your old policy.

Canine Liability Exclusion Endorsement

This policy is perfect for pet owners. Furthermore, you can ask for this policy if you do not have personal insurance. With this, you can be able to cover dog damage and bites. However, this damage must be carried out on another person’s property. In addition, you can also request veterinary services from your agent.

Additional Insured Endorsement

Additional Insured Endorsement offers coverage for your family or friends that are living with you. So, if you and another person want to use a particular policy, you can go for the Additional Insured Endorsement. But the person will have to be a third party. In conclusion, both parties can access the policy.

What Does An Insurance Endorsement Cover?

There are many things that an insurance endorsement can cover. So, no matter what you need, you can always be protected when you ask for it. Moreover, you can also ask for an insurance endorsement if you want to remove your ex-spouse from an insurance policy.

But the most common type of insurance endorsement is the homeowner’s policy. So, when you ask for support, you can be able to enjoy coverage based on the type of insurance you already have.

Plus, you can also decide to remove and change your policy. So, with the help of an insurance endorsement, this is very easy and fast.

How Do I Request For An Insurance Endorsement?

The quickest and easiest way to ask for an insurance endorsement is by talking to your insurance agent. This process is very easy for existing policyholders. So, if you need to include or exclude a particular coverage, demand an endorsement on your insurance.

In addition, you can also choose to talk to or speak to an agent by sending an email or using their active phone number. However, if you are finding it hard to locate a particular agent, you can make use of the general contact information and you can be redirected to the right agent.

What’s more, if you are new and you want to apply for or purchase a policy for the first time, you can still get insurance endorsements just by asking your agent. But make sure that you do a proper analysis of the type of endorsement that you need to make before carrying out this action or process.