Do you have a strong desire to learn What Happens When Debt Falls Off Credit Report? That is fine. I have got you. However, if you want to discover more, then I am going to need you to read to the end of this article. In 2020, the percentage of people in debt rose to 28%. Furthermore, it has not stopped there. A lot of people have one or two outstanding debts that they need to cover. But due to the lack of funds, they cannot achieve this.

What Happens When Debt Falls Off Credit Report? Sadly, the pile-up of these debts is affecting your credit score badly. In addition, improving these scores after settling these debts can be very hard. Moreover, you need to be aware that when you miss a payment, it will stay on your credit profile. What’s more, it makes it even more difficult to apply for a loan from a company or online lender. Nevertheless, after a specific number of years, the debt will finally fall off your credit report. But it is also depending on the situation.

How Long Does Your Debt Stay On Your Credit Report?

There are various numbers of years that debt or debts can stay on a credit report. Moreover, it also depends on the type of loan that you collected. Diminishing items might last on your credit reports for 7 to 10 years or maybe more.

The table below will explain more:

| LOAN TYPE | NUMBER OF YEARS |

| Chapter 7 bankruptcies | 10 years |

| Collection accounts | 7 years |

| Hard inquiries | 2 years. |

| Money undertaken by the government or money owed to the government | 7 years |

| Short sales | 7 years |

| Late payments | 7 years |

| Foreclosures | 7 years |

| Unpaid student loans | 7 years from the previous date paid or indefinitely. |

| Chapter 13 bankruptcies | 7 years |

| Unpaid taxes | 7 years from the final date paid or indefinitely. |

| Judgments | 7 years or Until the state statutes of limitations lapses. |

Is Paying Back A Debt That Has Fallen Off My Credit Report Necessary?

Just because your debt has fallen off your credit report, does not mean that it has left the record. However, if the debt is beyond its statute of limitations, then your liability and accountability may be different.

Moreover, since you collected the loan and have the debt, you are responsible for it. Plus, creditors and lenders might still try to get their money back. But you are advised to talk to a lawyer or attorney. And lastly, pay up your debts.

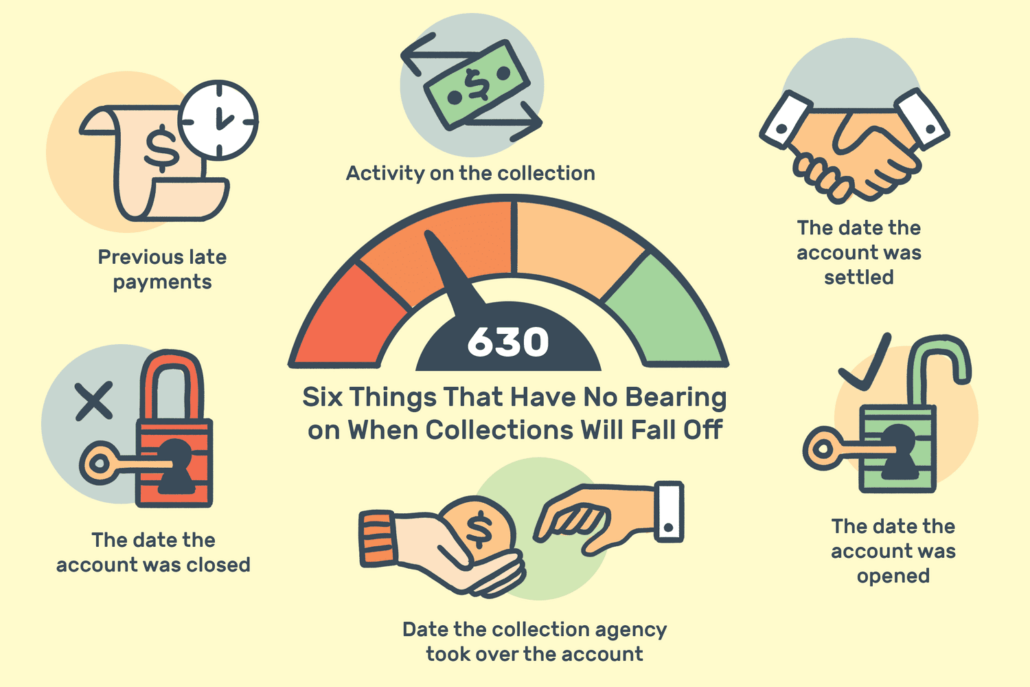

How Long Do Collections Stay On Your Credit Report?

If your lender’s information concerning an account’s misconduct is active and accurate, the collections record will stay for 7 years. So, this is how it works. When a lender sees an account is abandoned, the account will be transferred to an internal collection department.

Further, the account’s debt is sometimes bought by a debt collection agency. But this can only happen for about six months at the back of payments. What’s more, around this time, you will begin to hear from the debt collector who is now the sole owner of the debt.

When Happens To Your Credit Score When Derogatory Marks Fall Off Your Report?

The majority of the negative items will begin to fall off your credit reports automatically seven years after the date you defaulted on the first payment. Therefore, making your credit score begin to rise.

But if a negative item on your report is longer than the span of 7 years, you talk to the bureau to have it terminated.

Can You Ask Creditors To Report Paid Debts?

If a mortgage lender takes off a mortgage that was taken care of 10 years after the date of the previous payment, the lender may choose to report it to the three credit bureaus. So, yes, you can ask your creditor to report a paid debt.

However, some lenders may disagree but they can also include positive details to your credit reports with your old credit.

Should I Pay Debt That Has Fallen Off My Credit Score?

Yes, you are advised to take responsibility for your debt. Plus, even if the debt is not impacting your credit score, you should still make effort. Moreover, the lender may even sue you in court if you fail to pay up the debt.