How do I go about Tax refund on IRS and what if my Refund is taking too long to drop? IRS which stands for The Internal Revenue Service (IRS) is the revenue service that is responsible for collecting taxes and administration of the Internal Revenue Code in the United States. This body is also responsible for issuing tax refunds.

IRS issues Tax Refund to all taxpayers that pay more taxes to the state government or federal government than your true tax liability. The Refund you get from the IRS is a check for the overpaid tax. However, to get a tax refund, you must file a tax return.

A tax return is a form you file yearly that carries your income, expenses, investments, and any other tax-related information. Note that any information you bring will tell if you will be receiving a tax refund. So in order to get an IRS Tax Refund, you need to file for a Tax Return electronically or paper filing.

How to Apply for a Tax Refund

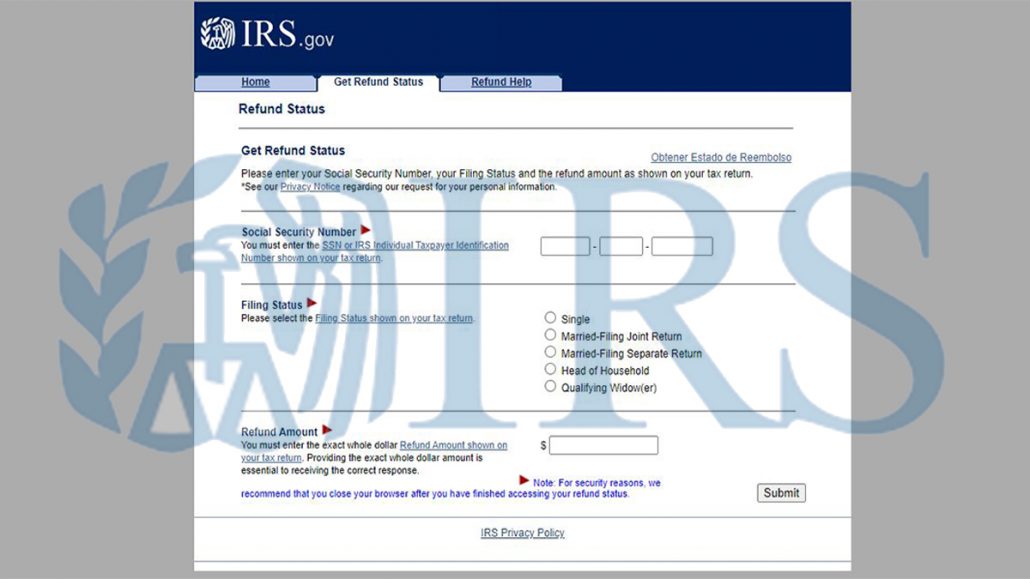

To get an IRS refund faster, you need to fill out a complete and accurate Tax return electronically. To file for a Tax Return, you need to visit the official website of IRS online and select file electronically file for a Tax return. Once you submit your return, you can check for the status of your refund using the Where’s My Refund online tool on the IRS official website. But if you didn’t file electronically, you can check your Refund Status 4 weeks after you mailed your Tax Return.

How Long Does it Take to Get An IRS Refund?

Once you file for a refund electronically, expect to get your refund in less than 21 days. However, if you don’t fill in the tax refund application form well, The IRS will be reviewing your tax return. Nevertheless, you can make use of the Where’s My Refund tool to check out information about your Refund.

Although, your tax return may take very long to process for many reasons and this may delay your Tax Refund. I have made a list of the possible reasons why your Tax Return may be delayed they include;

- Incorrect Recovery Rebate Credit

- If you don’t feel your Tax Return complete

- It may need further review

- If it includes a Form 8379, injured Spouse Allocation if this is the issue it may take up to 14 weeks to process.

How to Check Your Refund

For all taxpayers that filed for a refund electronically, you can go visit irs.gov and use the Where’s My Refund online tool after 24 hours of your e-file but if you filed you did paper filing then you need to check your refund status after 4 weeks of mailing.