What do the Federal Reserve Banks do and how do they operate? The Federal Reserve Bank is a regional bank of the Federal Reserve System. The Federal Reserve System is the central Banking of the United States of America that handles and manages all the financial policies of a State. It is known to be the most powerful financial institution in the world. Also, the Federal Reserve System is the financial institution that oversees the commercial banking system. In this article, I will discuss the operations of the Federal Reserve Bank.

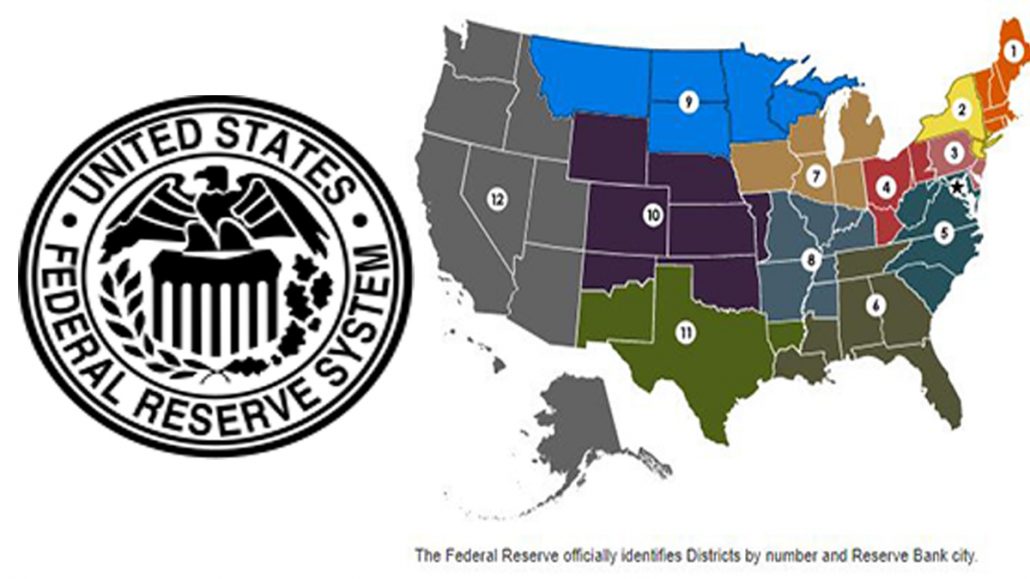

There are 12 Federal Reserve Banks in the United States of America one for each of the Federal Reserve Districts that was formed by the Federal Reserve Act. The Federal Reserve banks are in charge of implementing monetary policy. There also offer various functions and services both in the federal and private sectors. Some of the services offered by the Federal Reserve Banks Include Acting as a depository institution, lending money to other smaller banks to cover short-term funds deficit, delivering financial services, and more. All of the Federal Reserve Banks move with the same mission and vision to advance the United States of America financial system.

What Are The 12 Federal Reserve Banks?

The Federal Reserve Banks comprises 12 regional reserve banks one for each of the 12 Federal Reserve District. They include:

- Federal Reserve Bank, Boston

- Federal Reserve Bank, New York

- Federal Reserve Bank, Philadelphia

- Federal Reserve Bank, Cleveland

- Federal Reserve Bank, Richmond

- Federal Reserve Bank, Atlanta

- Federal Reserve bank, Chicago

- Federal Reserve Bank, St. Louis

- Federal Reserve Bank, Minneapolis

- Federal Reserve Bank, Kansas City

- Federal Reserve Bank, Dallas

- Federal Reserve Bank, San Francisco

What Does the Federal Reserve Bank Do?

The Federal Reserve Banks provide a wide range of services. In 1913 the Federal Reserve Act formed the Federal Reserve System to serve the central bank of the U.S.A. the board of governors, the FOMC (Federal Open Market Committee), and the board of directors formed another system of 8 to b12 Federal Reserve Banks. Below are the functions of the Federal Reserve Banks

- Oversee the Regional Fed Banks

- Facilitate Monetary Policy

- Supervise Members Institution

- Service the Government

- Service Depository institutions

Finally, the Federal Reserve Bank is popularly called the bank for banks. It carries out orders of the Central bank (Federal Reserve System), gives support to other smaller banks around the country. The reserve Banks performed functions other commercial bank does but the major difference is the Federal Reserve Banks offer this service to Banks and not individuals or businesses.