Progressive renters insurance is one of the best renter insurance providers which are accessible in various states such as California and Massachusetts. It is the eighth among other companies since it provides sales of renters insurance from another insurer to its own.

Generally, if you intend to secure a quote, it allows applicants to receive quotes from multiple insurers in one place. Additionally, Progressive’s premium rates typically rank in the upper range compared to other companies.

However, they offer various discounts for policy bundling such as renters and auto, full policy payments, and residency in gated communities, among others. In addition, Progressive provides optional add-ons like personal injury coverage and protection against water backup. These add-ons can safeguard your residence where water or other substances overflow from sewers or drains, causing property damage.

How Progressive Renters Insurance Works

Progressive renters insurance policy offers financial compensation for losses to your personal belongings that are covered under the policy. Moreover, you can file a claim with your insurer to collect reimbursement for your loss, up to the limits and sub-limits in your policy, and reduce any deductible.

Additionally, obtaining a quote for renters insurance is typically a quick and straightforward process. Your insurer will usually ask just a few questions about your rental unit and the value of your possessions.

How Much Does Progressive Renters Insurance Cost

The standard monthly expense of Progressive renters insurance ranges at $15.42, which is a little higher than the national standard expense of $15 per month. Moreover, policyholders could utilize discounts such as merging renters policy and car insurance to reduce their rates. However, you can obtain an online quote to determine the main cost of coverage for your specific needs.

What Does Progressive Renters Insurance Coverage Include

A typical Progressive renters insurance policy includes coverage components like liability coverage, personal belongings, and additional living expenses in case your rental unit becomes temporarily unsuitable.

Personal Property Coverage

This policy covers the expenses of repairing or replacing your possessions, ranging from clothing and furniture to appliances and electronics, within restrictions in your policy. Additionally, it may extend coverage to personal belongings while you are traveling or items kept in a storage unit.

Personal Liability Coverage

This policy covers the costs of repairing damages to someone else’s property that you accidentally cause. It also covers legal fees if you are legally responsible for the damage or if someone sustains injuries while in your rental home.

Guest Medical Payments

It is designed to cover medical expenses for guests who are injured on your property, irrespective of fault. This coverage usually ranges from $1,000 to $5,000 and covers minor injuries, potentially a lawsuit. Moreover, this feature provides added financial protection and peace of mind when hosting guests at your home.

Additional Living Expenses

This covers extra expenses, such as hotel accommodations, rent, and dining out, if your rental unit sustains damage that renders it uninhabitable. Furthermore, Progressive provides renters insurance in all 50 states and Washington, D.C., although availability might differ. However, it operates an in-house insurance agency named Progressive Advantage Agency. This agency sells policies from its affiliated carrier, Progressive Home, as well as from a third-party company named Homesite.

What Does Progressive Renters Insurance Not Cover

Progressive renters insurance policy does not include coverage for natural disasters such as floods, earthquakes, sinkholes, and landslides. It also excludes coverage for the building’s structure, pests, or your roommate’s belongings unless they are specifically named on your policy.

Additionally, wear and tear or pre-existing damage to your rental unit isn’t covered by the standard policy. Lastly, responsibility for damage and vandalism to your residence typically rests with your landlord.

Progressive Renter Insurance Discounts

Progressive extends numerous discounts to renters insurance customers, with most individuals meeting the eligibility criteria easily. Alongside a multi-policy discount, these aids in savings averaging around 3%, as Progressive offers the following discounts:

- Multi-policy discount

- Early quote discount

- Electronic document delivery discount

- Full payment discount

- Discount for residing in a secured or gated community

- Single deductible benefit for bundled policies

Considering these discounts can significantly reduce the cost of your insurance and are worth exploring when buying or renewing a renters insurance policy. For the most precise details and to determine which discounts you qualify for, it is advisable to contact Progressive directly or visit their website.

How to Buy Progressive Renter Insurance

Progressive provides quotes and purchases renters insurance through their online platform. When obtaining a quote, you will need to provide personal details like your name, birthdate, and the address of the rental property you wish to insure. Additionally, you will be asked about your employment status and living situation.

Also, you will be asked whether you own a dog and the number of retirees and full-time workers residing in the rental unit. If you have inquiries regarding purchasing a policy, you can utilize Progressive’s chatbot for assistance. Lastly, you have the option to speak with a Progressive representative directly or send an email for further clarification.

How to File a Claim with Progressive

Most times, Progressive functions as a broker, providing policies from both third-party insurance providers and its own. In addition, you will need to file any claims directly with the insurance company from which you bought the policy via Progressive’s online platform.

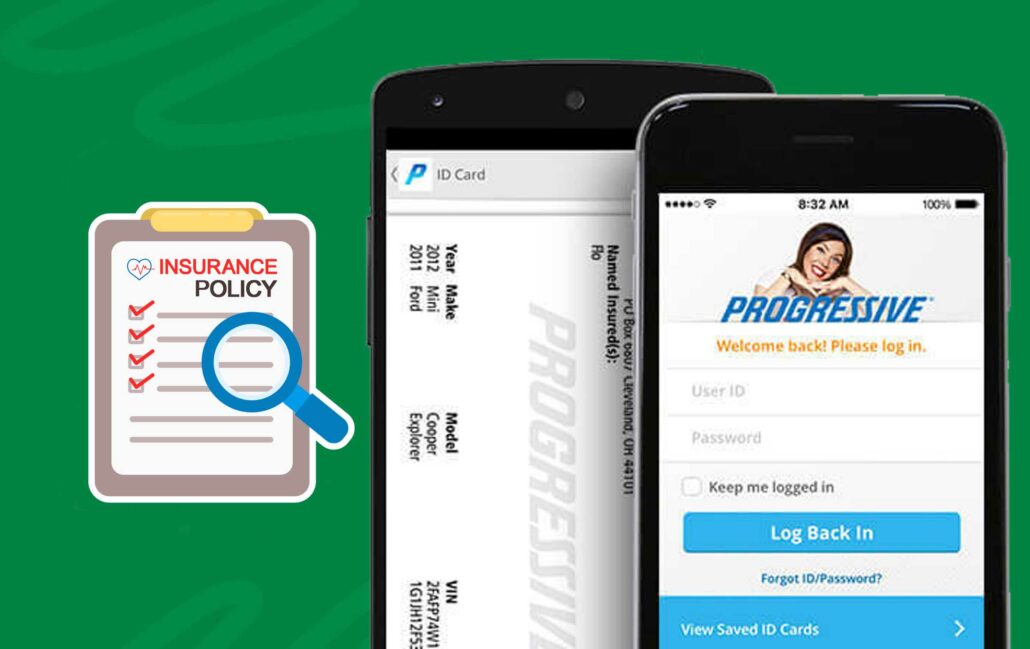

Moreover, Progressive can assist you in connecting with a respectable insurance company. You have the option to contact Progressive by phone, or you can access your account online or through the mobile app.

Progressive’s renters insurance rate across the nation falls within the mid-range compared to other carriers we’ve evaluated. However, they offer various discounts that could potentially reduce your insurance expenses.