Auto loans are secured loans that help borrowers pay for a used or new car. This type of loan lets consumers pay off their cars with fixed monthly payments instead of paying cash upfront. People who want to pay off their car quickly can use a car loan to refinance or buy a new or used car. Auto loans are available from a variety of lenders and dealerships. So, it is very important to shop around and compare to find the best auto loan interest rates and terms for your car.

The best auto loan rates will help you save more money over the life of your loan by charging you less interest. Besides, they come with easy application processes, financing options for either used or new vehicles, and flexible repayment terms.

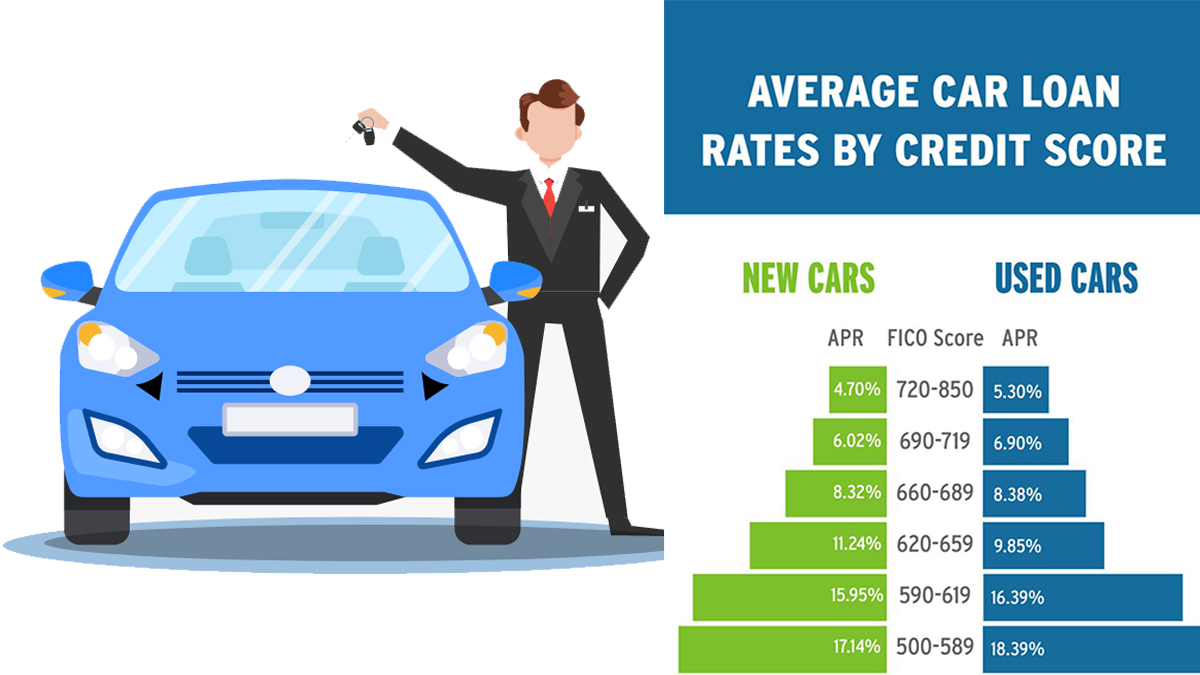

However, you always need to keep it in the back of your mind that to get the best auto loan rates, you need to compare APRs across different lenders. This will get you a competitive rate. Also, your credit score will have a very big effect on the rates offered. The higher your credit score, the better your loan rate will be.

Lenders With the Best Auto Loan Rates in 2022

Just like I mentioned above, it is better to look for lenders that can keep fees to a minimum. And you can also offer repayment terms that suit your needs. The auto loan lenders listed below are selected based on different factors, and they offer the best auto loan rates. Check them out and choose the top lender that fits your needs.

PenFed Credit Union

PenFed Credit Union offers some of the best and lowest rates available. It has flexible loan amounts and different auto loan options for its members. Even though membership is a must, PenFed makes the requirements for joining fairly and straightforward. It offers amazing advantages to its members, such as used, new, refinanced loans, allowing members to borrow up to 125% on used and new vehicles, and loan amounts from $500 to $100, 000.

This lender offers the lowest rates available on this list. At PenFed, rates for 36-month refinance loans begin as low as 1.79%. A deep discount is available for people who make use of the credit union buying service, with rates as low as 2.29% (APR) for a new car and 3.19% for a used car. As with most lenders, you will also need very good credit to get the lowest rates.

Bank of America

Bank of America provides a new car loan APR of 2.39% to people with good credit, beating out most lenders by a tenth of a percent. Used car rates begin at 2.59% and if you are refinancing an already existing loan, refinancing begins at 3.39%. Bank of America preferred rewards members can also get an amazing interest rate discount of up to 0.4%.

As a national bank, this bank works with a wide variety of dealerships across the United States. This means you do not have a limit to your options. However, you need to know that Bank of America will not finance vehicles that are older than 10 years or with more than 125,000 miles on the odometer. It also does not finance cars under $6,000 in value or vehicles like RVs and motorcycles.

Consumers Credit Union

Consumers Credit is another good option for low auto loan rates. Based in Illinois, the credit union offers membership to anyone in the country who can pay a 5-dollar fee and keep at least 5 dollars in a savings account.

This credit union has an A with accreditation from the BBB. Consumers Credit Union’s auto loan products are available for members with good credit. Just like PenFed Credit Union, Consumers Credit Union partners with TrueCar in order to help shoppers find vehicles from across the country.

The only difference is that buyers can still get the same interest rates whether they shop from TrueCar or not. At this time, rates begin at 2.49% for new car financing and 2.74% for used car financing. Consumers Union provides a 0.25% discount on the rate for using autopay and an extra discount when the autopay is linked to a consumer’s credit union account.

LightStream

LightStream is the online lending arm of the popular SunTruist Bank. It is well known for its easy online lending process. People can apply online, sign the loan agreement, and receive the funds via direct deposit as soon as the next day. LightStream offers a remarkably wide range of auto loan options, including used and new dealer purchases, lease buyouts, refinancing, and classic cars.

It also offers unsecured loans for people with excellent credit. Rates from this lender begin as low as 4.99%, which also includes a 0.5%-point discount autopay. The maximum APR on an auto loan is 9.49%. However, you need to know that all of these are only available to people with excellent credit.

Chase

Chase Auto offers a secure, stable financial offering with a high loan amount, competitive rates, and a concierge car-buying program that makes it very easy to get the best rates and financing options for used cars. Although Chase does not list rates online, it offers a calculator that will allow you to get an idea of your rate.

It also offers generous loan amounts ranging from $4,000 to $600,000 and 12 to 84-month repayment terms. Chase does not require you to make a down payment on a loan. Putting money down can reduce the total amount you need to borrow and your monthly payments.

You can also get a 0.25% interest rate discount if you are a Chase private client. This requires you to have a minimum average daily balance of $150,000 in qualifying business, personal, and investment accounts or a Chase Platinum Business Checking account.

Visit the above lender’s website for more information about the auto loan rate. They have more than enough information to get an idea of your rate.

CHECK IT OUT <<< VA Loan Rates – Current VA Mortgage Interest Rates